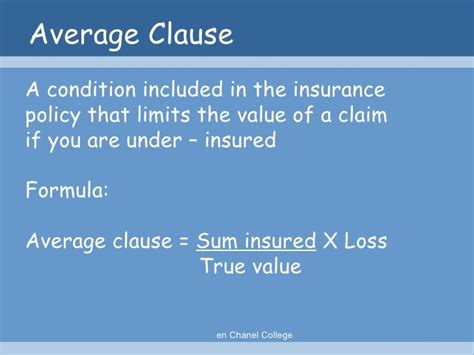

average clause under insurance formula|How the Average Clause affects your business insurance : Manila Keywords: Average clause, insurance contract, insured, under-insured, financial advisor. Under-insurance can have dire consequinces for insurers if they are held liable for .

Pwede kang Manalo ng exciting prizes daily, P50k weekly, at ang grand prize na P1 million ‘pag sumali ka sa PEEL MO PANALO PROMO sa COKE STUDIO! Just.Mehr als 5 Millionen Porno-Videos bei xHamster kostenlos anschauen! Streame auf unserem Sex-Portal neue XXX-Videos, durchsuche Sex-Fotos oder triff dich mit Girls zum gepflegten Vögeln!

PH0 · What is the Average clause in Insurance?

PH1 · What is an average clause?

PH2 · Under

PH3 · The principle of average

PH4 · The average clause and its implications for your

PH5 · How the Average Clause affects your business insurance

PH6 · Condition of average

PH7 · Calculation of Actual Amount of Claim

PH8 · Average clauses in insurance policies

PH9 · Average Clause in Fire Insurance

Thick rich flavor pizza sauce with melted mozzarella cheese, pork pepperoni, pork Italian crumbles, black olives, a bit roasted white onion and green bell pepper slices. Popular. 0. 18" Garlic Shrimp Pizza. from ₱ .

average clause under insurance formula*******The average clause only applies when the sum insured is less than the actual value of the goods or the property. The amount of claim that the insured gets is calculated as follows: Claim amount = (Actual .

Condition of average (also called underinsurance in the U.S., or principle of average, subject to average, or pro rata condition of average in Commonwealth countries) is the insurance term used when calculating a payout against a claim where the policy undervalues the sum insured. In the event of partial loss, the amount paid against a claim will be in the same proportion as the value of the . So what is an average clause in an insurance policy? It is a clause requiring that you bear a proportion of any loss if your assets were insured for less than their full .

The actual amount of claim is determined by the formula: Claim = Loss Suffered x Insured Value/Total Cost. The object of such an Average Clause is to limit the liability .

The formula employed to calculate the claim amount under the Average Clause in Fire Insurance is as follows: Claim Amount = (Sum Insured / Actual Value of .Keywords: Average clause, insurance contract, insured, under-insured, financial advisor. Under-insurance can have dire consequinces for insurers if they are held liable for .

The average clause and its implications for your insurance coverage. (or, do you know the consequences of underinsuring your property?) When homeowners or businessmen try to cut their property insurance costs, . What is the Average clause in Insurance? Explore the average clause in insurance, its impact on payouts in the event of a claim, and the importance of accurate .

The drum set is under-insured by 30%, calculated by dividing the difference between the sum insured and the replacement value. Due to the understatement of the .average clause under insurance formula The Average Clause is a policy term that restricts the total payout based on the proportion of the value covered. For instance, if a company insures a building .

In cases of underinsurance, the insurer may choose to ‘apply average’ to the claim under a policy’s average clause. This usually means reducing the claim in line with the proportion of underinsurance. So if the sum insured is £300,000 but should have been £500,000, the insurer will pay 60% of the claim value.How the Average Clause affects your business insurance What is the Average Clause in a Property Damage and Business Interruption policy? The Average Clause is a policy term that restricts the total payout based on the proportion of the value covered. For instance, if a company insures a building asset for less than the full cost of rebuilding it (e.g. $6 million out of $10 million, or 60%), the . What is the Average Clause in a Property Damage and Business Interruption policy? The Average Clause is a policy term that restricts the total payout based on the proportion of the value covered. For instance, if a company insures a building asset for less than the full cost of rebuilding it (e.g. $6 million out of $10 million, or 60%), the .Other factors that influence your insurance • Example of how Average is Calculated . Example of How Average is Calculated. The unit is insured for R900,000.00. However, the unit’s correct replacement cost is R1,400 000.00. . If the average clause is applied by the insurer, the total the insurer will settle for a loss of R650,000.00 will . Coinsurance Clause or Average Clause An insurance policy for a property owner is accompanied by a detailed and complex contract that will contain clauses, provisions and responsibilities that are .Property Underinsurance and ‘The Average Clause’. The primary purpose of property insurance is to provide a safehold when you sustain a loss that you simply cannot afford. However, at Glowsure we often see clients whose property is 70-80% underinsured. A previous client’s property was underinsured by over £1 million. The average clause in fire insurance can be calculated by another method given below. Value of goods: INR 1,00,000. Insured value: INR 30,000. Loss due to fire: INR 20,000. In this circumstance, INR 30,000 represents the value of goods which is 30 per cent of the total value of goods. The loss incurred due to the fire is INR 20,000 (20 per .

In the event of a claim, the principle of ‘average’ would be applied. The formula determining average is as follows: (Sum Insured / Value at Risk) x Amount of Loss. Example. Let’s say Keith’s townhouse is insured for R500 000, but it’s actually worth R1 million. One day, while Keith is at work, an electrical fault causes the entire . Underinsurance: Inadequate insurance coverage by the holder of a policy. In the event of a claim, underinsurance may result in economic losses to the policy holder, since the claim would exceed .Under-insurance can have dire consequinces for insurers if they are held liable for the full value of the damage that occurred while an insured only paid small premiums in relation thereto. It has become common practice under insurers to insert an average clause into insurance contracts to protect themselves in instances of under-insurance. If the fire insurance policy uses the pro rata condition of average, the insurance company is only liable in proportion to the level of insurance relative to the value of the property. Since the .Under the average clause, the policyholder agrees to maintain a specific percentage of insurance coverage based on the property’s actual value. This percentage, known as the “coinsurance percentage,” is typically mentioned in the policy. . If a fire causes partial loss or damage, the claim payout is determined by the formula: Claim . The clause is included in policy wordings as a specific condition for all policies in the fire and associated perils class. It is best to illustrate the average clause with an example: Consider a set of drums insured by a musician on a personal all risks policy for R140,000 – a value provided by the insured to the insurer and recorded as such . The average clause in insurance is a provision that applies when your property is undervalued or underinsured at the time of policy purchase. It affects the claim settlement in case of a partial loss due to fire. A partial loss is when your property is not destroyed by fire but only partially damaged. Under the average clause, the insurer .

GENERAL AVERAGE. In the marine insurance industry claims are divided into two categories, particular average and general average. General average claims relate to losses directly related to a sacrifice made as a result of a catastrophe at sea, all other losses are known as particular average losses. The definition of a general . A lot of property owners assume that the market value of their home is the amount they should insure the property for. But when it comes to insuring your home, it’s the actual rebuild value that matters, and that’s where the average clause comes in. The average clause is a big deal in the UK, and is catching a lot of property owners out.

Average Clause in Fire Insurance Policy is an important clause in determining the Claim Amount that will be paid to the Insured. The Clause comes into play when the Policyholder has underinsured the Property. In such cases, the Claim Amount will be subject to a proportionate deduction subject to the extent of Underinsurance.

The maths behind the clause is simple – If you’re insuring a house and the rebuild cost is £100,000 but for whatever reason you only request £80,000 as cover – Insurance companies can apply the average clause in the event of a claim and will deduct from settlement the amount that was under insured, so for example if the true cost of re .

With Vidizzy, you can dive into spontaneous conversations with strangers from around the globe, adding a touch of unpredictability to your online interactions. At Vidizzy, the possibilities are endless, and the next intriguing connection is just a click away.

average clause under insurance formula|How the Average Clause affects your business insurance